Adobe - Strategic Analysis

Downloadable Report

Introduction

Adobe, founded in 1982, is a prominent and diversified software company known for offering a wide range of products and services used by creative professionals such as photographers, video editors, graphic and experience designers, and game developers. Their products and services also extend to communicators including content creators, marketers, students, knowledge workers, and businesses of all sizes. Adobe’s products and services are used for a wide range of applications, but the core belief that drives their business is a powerful idea, of supporting the creation of digital works and projects for the betterment and enjoyment of humanity. Adobe’s products run on desktop and laptop computers, smartphones, tablets, other devices, and the web, depending on the product. Their products are offered through Software-as-a-Service (“SaaS”) model as well as through term subscription and pay-per-use models.

To differentiate Adobe’s business structure, the company’s management has divided its operations into three distinct operating units: Digital Media, Digital Experience, and Publishing/Advertising. The largest of these units is Digital Media, which encompasses Adobe’s flagship service, Adobe Creative Cloud. Through a subscription-based Software-as-a-Service (SaaS) model, Adobe offers different price tiers of its powerful software and storage applications to users worldwide. The Digital Experience segment, on the other hand, is geared towards serving businesses. Here, Adobe provides tailored customizations to its industry-leading software packages, along with powerful web analytics and marketing tools. These tools enable large corporations to operate more efficiently and effectively, ultimately boosting their bottom lines. Finally, Adobe’s last business segment includes its legacy offerings and services, which involve the licensing and maintenance of its software solutions for web development, high-end printing systems, and other mission-critical applications.

Business Model

Advancements in cloud computing performance and the widespread adoption of high-speed internet have brought about a radical transformation in the software industry. In the past, software companies used to sell expensive individual software licenses, but now many of them have shifted to a Software-as-a-Service (SaaS) business model. This type of business model offers several advantages. Firstly, it provides companies with a steady and recurring stream of income, which can be utilized to fund future product development and enhance existing offerings. SaaS is also beneficial for customers as it allows them to try and test software at a relatively affordable cost, and they can benefit from quicker updates and new features. However, there are also some caveats to consider. For instance, SaaS reduces switching costs for customers, which may be advantageous for them but may pose challenges for companies. Additionally, while companies receive steady cash inflows, customers need to adjust and account for recurring cash outflows. Understanding both business models and their trade-offs is crucial when evaluating the strategic outlook of a company.

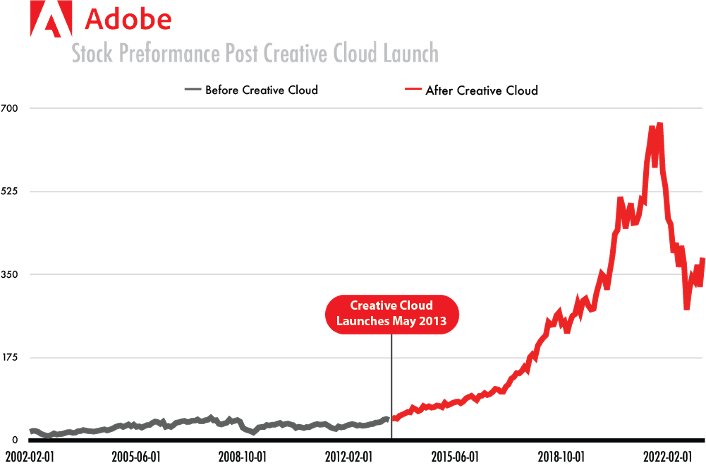

Adobe is an interesting subject case because it has operated under both models. Prior to 2013 the company made most of its money through one-time licenses. Between 2013 and 2015 the company began a soft transition and sold both licenses and subscriptions. Beginning in 2016 the company completed the transition and now only offers its software through a subscription. Figure 1.10 illustrates how powerful the transition to a SaaS (Software as a Service) business model is to the valuation Adobe.

Environmental Factors

As consumers increasingly shift from personal computers to tablet and mobile devices and from desktop to the web, the need for businesses to adapt to these changes is becoming increasingly important. While Adobe offers its products on a variety of platforms, failure to adapt its products to these changing trends could result in a negative impact on the company’s business. In addition, new releases of devices or operating systems may pose challenges for Adobe’s products to perform seamlessly or require significant investments to adapt to these changes. The most recent example of this was Apple’s switch to Arm based chips on its Mac computers which has forced the software companies to develop Arm specific applications.

As a company, Adobe has been incorporating AI technology into many of its offerings. While AI presents significant potential benefits, it also brings forth certain risks and challenges that could impact its adoption and, consequently, the company’s overall business operations. Offering tools that may be deemed controversial due to their perceived or actual impact on society could result in brand or reputational harm, competitive disadvantage, or even legal liability. Furthermore, potential government regulation related to AI use and ethics may increase the burden and cost of research and development, and failure to address AI usage or ethical issues properly may undermine public confidence in AI, thus slowing its adoption in Adobe’s products and services. Therefore, it is crucial for Adobe to carefully navigate the challenges and risks that come with integrating AI technology into its offerings while staying aligned with ethical principles and regulatory requirements.

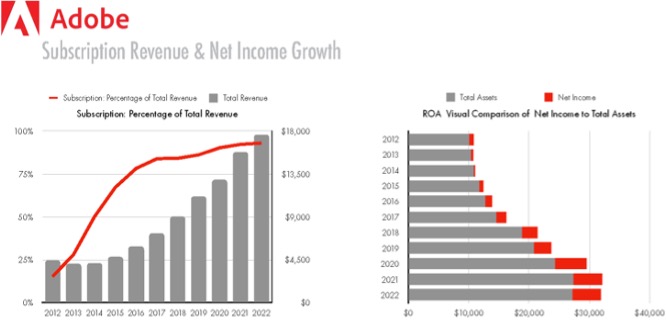

Macro-economic factors also pose a significant risk to adobe’s business model. Adobe’s business over the past ten years Adobe has undergone a dramatic shift from the traditional software sales model to a subscription model that accounts for 93% of total revenue (Figure 2.10). For Adobe’s and many companies this model is untested in a recessionary environment. Though not in a recession at the moment the US economy has been flooded with inflationary pressures since early 2021 this has forced the Federal Reserve to raise interest raise at a record pace of over 4% alone in 2022. This level of quantitative tightening by the central bank has done little to temper inflation thus far which could speak to the strength of the underling US economy or the more likely culprit the $7.4 trillion dollar printed since the beginning of 2020. Regardless of causality, the economic ramifications of stagflation and slow economic growth could very well force customers to cancel or significantly reduce the amount they are willing to pay for Adobe’s creative software.

Internal Factors

Adobe provides a range of products and services, but they are all tailored to support creative design projects. Adobe’s expertise, focus and specialization in design software allows it to move quickly and efficiently compared to competitors when it comes to developing and releasing new products and features. This is a significant advantage that allows it to stay on top of emerging trends and advancements in the design industry, ensuring that its solutions are always cutting-edge and up to date.

As alluded to previously Adobe uses a functional operating structure and divides its businesses into three operational segments: Digital Media, Digital Experience, and Publishing/Advertising. This allows the C-Suite management to evaluate the performance and growth of each area of the business. This segmentation continues at lower levels of the company as well. In common fashion for software companies each product or application gets its own development team(s) and project managers. Feature development and improvements are then further delegated to individual developers or smaller teams.

The company is also working to improve the culture and internal work environment among employees. Per Adobe’s annual letter the company is committed to building an inclusive and community centered work environment for all its employees (Adobe 2023). To achieve this the company has outlined a three-part strategy. First the company is taking actions to improve employee retention, benefits, and the promotion of a more diverse workforce. Part two aims to improve the workplace that inspires employees in their work and fosters a genuine sense of community from all parts of the company. Part three the company will provide grants that allow its products and ecosystem to be accessible to non-profits.

Industry Analysis: Porter’s Five Forces

1) Rivalry

Adobe competes in three areas of the cloud and software industry, Creative Design Software, Customer Experience Software, and Publishing/Advertising Software. Adobe has worked hard integrating these different areas of the business to create synergies between its products and services. This level of integration and fluidness between services is a unique differentiator and has improved its competitive advantage. With one simple subscription customers have access to Adobe’s extensive suite of design tools and cloud storage service. But Adobe’s ecosystem does come with a significant disadvantage that its rivals like to exploit.

Adobe operates in a highly competitive global environment, with competitors spanning various industry segments ranging from large multinational corporations to smaller entities with more narrowly focused product offerings. While Adobe’s ecosystem is unmatched in breadth and uniqueness, it comes at a high cost for both Adobe and its customers. Developing, innovating, and maintaining dozens of software applications for various platforms is expensive, as evidenced by Adobe’s 2022 annual statement showing over $5 billion spent on software maintenance and research and development expenses combined, roughly equivalent to 40% of total expenses. Although Adobe’s rivals are generally smaller in size, they can offer far cheaper products compared to Adobe, and some even offer free products that are just as powerful. While it’s unlikely that Adobe will face a competitor with an ecosystem as compelling as its own, it faces competition from rivals who can offer equivalent products at a fraction of the price. This competition is most visible on Adobe’s income statement, where its greatest expense was the $4.97 billion spent on advertising and marketing, nearly twice as much as its R&D costs.

2) Supplier Power

Adobe’s products and services like other software companies does not directly rely on the supply of physical materials or parts. An argument could be made to use the supplier of computers as Adobe’s input. This would be a logical or even valid approach several years ago when processing power was costly. But today the cost to performance is minimal and many employees even prefer to use their own machines for work. So, a new measure is needed to measure the supplier power. For this analysis Porter’s Five Forces is modified where the bargaining power of suppliers has been substituted for employee bargaining power. Since it is the expertise, knowledge and dedication of its workforce that supplies Adobe with new and innovative solutions.

While there is not an exact or precise way to measure employee bargaining power, we will attempt get a relative idea by looking at companywide employee attrition rate. According to Adobe filings for the fiscal year of 2022 its employee attrition rate was 11.7% generally rates below 10% are considered exceptional and anything above 20-30% is considered high. Unfortunately, accurate numbers for Adobe’s competitors can be difficult to come by but for comparison Google which has been consistently rated one of the best places to work had an employee attrition rate close to 40% in 2022 (Alphabet, 2022). Employee bargaining power has also been diminished with the recent layoffs across the country which amounted to more than 100,000 tech employees losing their jobs alone in 2022 (Capoot, 2023). Because of these reasons we rate employee or supplier bargaining power relatively low for Adobe and the software development industry.

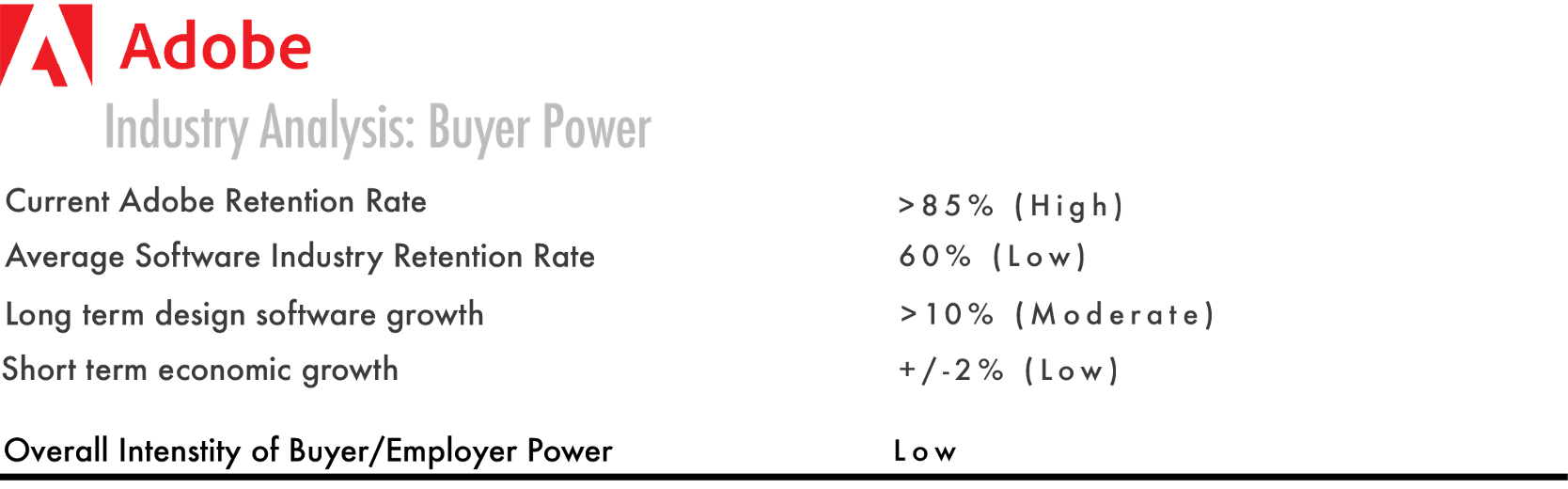

3) Buyer Power

As previously explained Adobe operates in the software industry and, like its peers, does not typically negotiate with traditional suppliers. However, it sometimes must compete for skilled employees. To assess buyer power in this industry, we can look at the growth rate of software engineers compared to the overall economy. According to the Bureau of Labor Statistics the “Software Engineer” roles are expected to growth at 25% annually much faster than the aggregate economy. In the short term however there have been extensive layoffs throughout the tech sector as companies realize they over hired. This suggests that in the short-term companies or buyers in the software industry have more bargaining power than employees or suppliers. However, in the long term when the economy rebounds employees will see a rise in relative bargaining power while buyers will lose power. For this reason, the software industry has a low to moderate buyer bargaining power.

4) Threat of New Entrants

The Software industry in general has very low startup and fixed costs compared to other industries. Niche startups often operate with little to no capital and it’s not uncommon to see them quickly generate significant revenues. The low operating overhead, and exponential return make the software industry high lucrative and attractive to new entrants. The low cost of entry and lucrative opportunities make the software industry highly disruptive and perfect for new entrants.

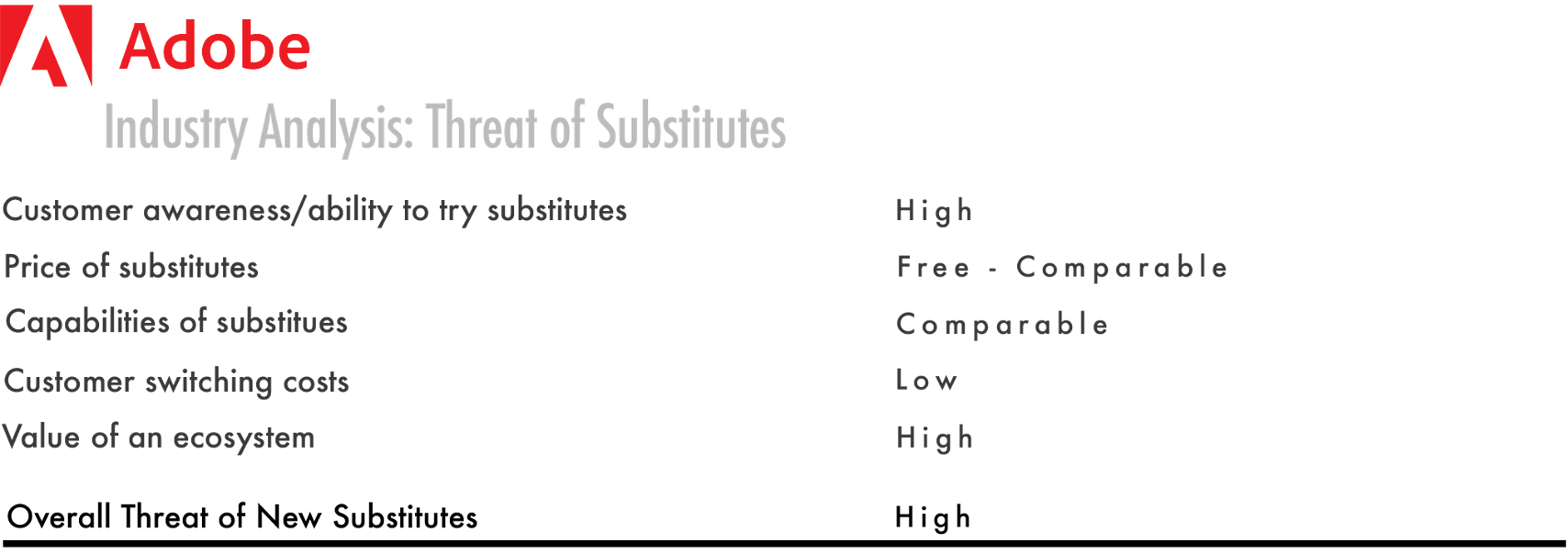

5) Threat of Substitutes

In the software industry, new entrants and their alternatives are likely to emerge. Companies, regardless of their size, develop alternatives to their competitors’ products that are often cheaper or even free. For example, Google offers free productivity tools that Microsoft had previously charged hundreds of dollars for. This is a popular tactic that Google has used in other areas. While Google does not provide free substitutes for Adobe’s design tools such as Photoshop or Premier, it competes with Adobe in analytics software. Software companies are not just threatened by their peers. Often the greatest level of competition is the startup that goes undetected for years. For this reason, software companies must remain extremely agile, innovative and in touch with customers else they risk the threat of disruptive substitutes stealing their market share.

Industry Analysis Summary

The software industry, including the creative application industry, is known for its high competitiveness, with relatively low barriers to entry and high potential payoffs. This means that new players can enter the market relatively easily, leading to increased competition. Additionally, the constant evolution of technology and changing customer preferences make the market dynamic and fast-paced. Despite the potential for high demand and customer interest in creative applications, the level of profitability in the industry is assessed to be moderate. This is due to various factors, such as intense competition among existing players, the need for continuous innovation to stay ahead, and the requirement for substantial investments in research and development to develop and maintain cutting-edge software products.

Value Chain Analysis

Like the Five Forces analysis the generic value chain model does not perfectly encompass the Activities of a pure play software firm like Adobe. Our model is very similar in structure and flow but the with updated core and supporting activities that better represent the value chain of a software company.

Analyzing the supporting activities, we can see that there are four in our model. Supporting activities are areas of the firm that are not directly involved with the product(s). Starting with Firm Infrastructure which represents the systems and processes in place that help the different areas of the company work together. Administrative activities represent legal and financing tasks the firm must complete to remain operational. Human Resources is responsible for managing the firm’s human capital needs and requirements. The last supporting activity is technology development, which refers to any new technologies or updates to existing internal technologies.

We have identified four key steps in the value chain of pure play software companies. The first step is the Research phase, which involves analyzing customer pain points and needs, formulating potential solutions, and using a project evaluation framework, such as the Design Thinking Framework, to decide on whether to move to proceed to next step.

The second step is the Product Development & Management Phase. Once a project has passed the initial feasibility and desirability hurdles, management outlines its development path and software engineers and UX designers begin building prototypes and eventually the final product. Throughout the development process, management continuously monitors progress and assesses the feasibility of the project.

The third step is Marketing and Sales, which often begins concurrently with the development of the product. Marketing formulates advertising campaigns while sales coordinate business partners to make the rollout seamless and successful.

The supporting and core activities contribute to the overall success of the firm. These activities are essential and are designed to create value and their efficiency and effectiveness ultimately impact the profitability of the firm. The supporting activities, such as firm infrastructure, administrative activities, human resources, and technology development, provide the necessary support and resources to the core activities, which include research and development, product design and management, marketing and sales, and customer service. By optimizing these activities and achieving operational excellence, Adobe can improve its profit margins and financial performance.

Firm Key Strengths, Weaknesses, Threats, and Opportunities

One of the most common approaches to assess the qualitative features of a business is to conduct a SWOT analysis. Our SWOT analysis of Adobe’s business highlights several important strategic strengths, weaknesses, opportunities, and threats that management and shareholders should be conscious of.

Adobe has a significant strength due to its extensive experience in the software industry and strong brand image with professionals. The company has been designing applications since 1982, giving it more experience than most of its peers. In fact, Adobe has more than twice as many years of experience compared to its competitors such as Canva and DocuSign. This experience and longevity have allowed the company to build a large ecosystem used by universities and businesses and build a loyal community of users.

Those strengths also come with several weaknesses. The company’s large ecosystem is great for attracting customers but the overhead of developing and maintaining dozens of applications for multiple platform results in slower feature improvements and longer update cycles. Additionally, as the Five Forces analysis demonstrated Adobe’s industry is highly disruptive and the company’s growth is largely dependent on marketing its products better than competitors.

As emerging technologies like Augmented Reality and Artificial Intelligence become more widely adopted in the coming years, there will be a growing demand for new types of content. These advancements and new mediums present significant opportunities for growth. If Adobe can effectively execute and leverage its expertise and ecosystem to serve these technologies, it has the potential to achieve even greater market dominance and profitability.

The software and creative application industry is highly competitive, with new entrants constantly entering the market and striving to differentiate themselves from the competition. This poses a significant threat to Adobe, as younger and more agile competitors may challenge its market position. Contrary to the popular belief that successful companies are often first movers, Adobe’s younger competitors may have the advantage of being last movers. The concept of “last mover advantage,” as popularized in Peter Thiel’s book Zero to One, suggests that companies that are not the first movers have an opportunity to capitalize on and correct the mistakes made by the early entrants in the industry. As Adobe was an early mover in many of its creative applications, it may face competition from younger companies that aim to serve customer needs that Adobe failed to recognize.

In addition, Adobe also faces cybersecurity threats that target its infrastructure, customer data, and intellectual property. Hostile actors and foreign governments pose constant threats, and a severe attack could result in a loss of trust with customers and partners, as well as theft of assets and intellectual property.

Firm Governance & Structure

Adobe is a public traded company and pursuant to US law its governance structure must include a board of directors who are elected by the shareholders. Adobe’s Board is made up of twelve members that are elected annually every spring on a non-staggard basis. Adobe’s current CEO Shantanu Narayen also sits on the board of directors this is often seen as a conflict of interest and in recent years companies have been discouraged to let CEO’s sit on the board. The board meets multiple times throughout the year to discuss financials, ESG activities and executive compensation.

Shantanu Narayen has been at the company for 25 years and served as CEO since 2007. Shantanu has transformed the company he has led the company’s efforts in pioneering an unrivaled subscription-based cloud and software ecosystem. Under his leadership the company’s net income has grown from roughly $723.8 million in 2007 to more than $4.76 billion in 2022 a 6.5x improvement or 43% growth annually (Adobe Inc., 2007-2022).

Corporate Responsibility

Adobe believes that everyone has the right to share their story and that creativity is accessible to all. The company is committed to empowering creators of all ages and backgrounds to access the necessary tools, skills, and platforms to express themselves, reach their full potential and share their unique and diverse perspectives with the world. To Achieve this Adobe has partnered with Khan Academy and together they provide millions of students worldwide with high-quality educational resources and fluency in creative skills.

Adobe is also committed to environmental sustainability. It’s biggest commitment yet is its promise to achieve a zero-carbon operational footprint. This includes developing digital products that encourage customers to priorities sustainable practices. The company has demonstrated its dedication to energy efficiency and renewable energy practices by setting a goal of achieving 100% renewable energy by 2035. The company is also preparing to open a fully electric office tower at its San Jose headquarters later this year (Adobe Inc., 2022).

Effects of R&D Spending on Financial Performance

The Adobe business primarily targets professional and business users who require stable software to handle heavy workloads and complete niche tasks. Historically, Adobe has focused on creating feature-rich and highly customizable applications to meet the needs of professional users. However, recent advancements in computer vision and AI have made it possible for machines to perform many of the tasks that previously required skilled designers. As a result, Adobe has invested heavily in these technologies targeted to advanced and novice users. One such product is Adobe Express, a powerful cloud-based design tool that can design logos, remove backgrounds, and create social media posts. This move has allowed Adobe to attract a new type of customer who may not necessarily be professional designers but can use Adobe’s tools to produce comparable results. By doing so, Adobe has been able to appeal to customers who would have otherwise been discouraged by the high learning curve and cost associated with Adobe’s professional suite of applications. The company has also expanded its software offerings beyond its traditional focus on feature-rich and desktop applications to include touch-enabled software, 3D modeling, AI-powered design, and augmented reality.

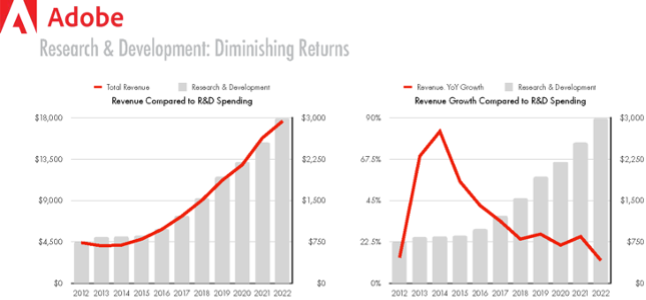

Per the company’s annual statements for the last five years the company has spent 15-17% of revenue on Research and Development. For 2022 this amounted to more than $2.9 billion dollars and was the companies second largest expense just behind sales and marketing expenses. Research and Development expenses consist primarily of employee compensation and data center costs and patent filings.

To determine if there is a link between R&D spending and profitability and ROA a five-year comparison analysis was conducted to determine if there is a relationship. Figures 6.10 show there is modest correlation between R&D and financial performance. Although these graphs depict modest levels of correlation (R2 = 0.75). Correlation alone is not enough to determine causality. For Adobe it is difficult to determine the exact driver of ROA growth because the company’s business is incredibly dynamic. It is our belief that the transition to a SaaS business model has been the most significant driver of ROA growth and has radically transformed Adobe’s trajectory. The high reoccurring cash flows of its subscription model has allowed it to spend more R&D projects and expand into new product categories faster. Prior to 2013 the company sold expensive one-time purchase software. Figure 6.10 shows that during that period the company’s Net Income and R&D were essentially the same meaning what it put-in it got-out. Then when the company began offering both a subscription and one time purchase software Net Income dropped significantly from $832 million in 2012 to below $300 million in 2013 and 2014. At the time the subscription model looked to be failing so, in 2015 instead of reverting course the company doubled down and decided it would only sell its software through a subscription. Because of this action by 2016 the company’s net income was once again more than its R&D spending and in 2022 it was almost double R&D spending even though R&D spending was 3x times more than it was in 2016. It could be argued that the R&D spending that went into the transition to a SaaS business model indirectly contributed into ROA growth but ultimately it was the reoccurring subscription revenue that has driven ROA higher (Adobe Inc, 2012-2022).

Competitive Actions

In this section we will analysis competitive actions Adobe has taken to prevent the competition from gaining market share. For our analysis we measured competitive actions in several areas such as patent filings, product releases, R&D spending and their effects on financial performance measured by Revenue and ROA. Since the competitive actions are measured using different data types (numerical: number of patent filings, product releases, acquisitions and continuous: marketing expenses) and because they differ in scale i.e., there could be 800 patent filing but only 1 acquisition we must normalize the data so they can be equally compared. To accomplish this, we used min-max scaling for each feature and then found the sum all the features for each year and this represented the number of competitive actions for the year.

The result show (Figure 7.10) that there is far lower correlation between competitive actions and financial performance than we would like to see. Although the results are not conclusive this is a far more accurate method of measuring competitive actions but in the future several improvements could be made such as to use a ratio of marketing costs to revenue which would help from skewing the results towards the tail. Additionally, since there are only four features (patent filings, product releases, marketing expenses and acquisitions) the max competitive action can only be four which could underrepresent the true level, in the future more features may be appropriate. For the curios reader the data and normalizations for each measurement can be found in the appendix of this report.

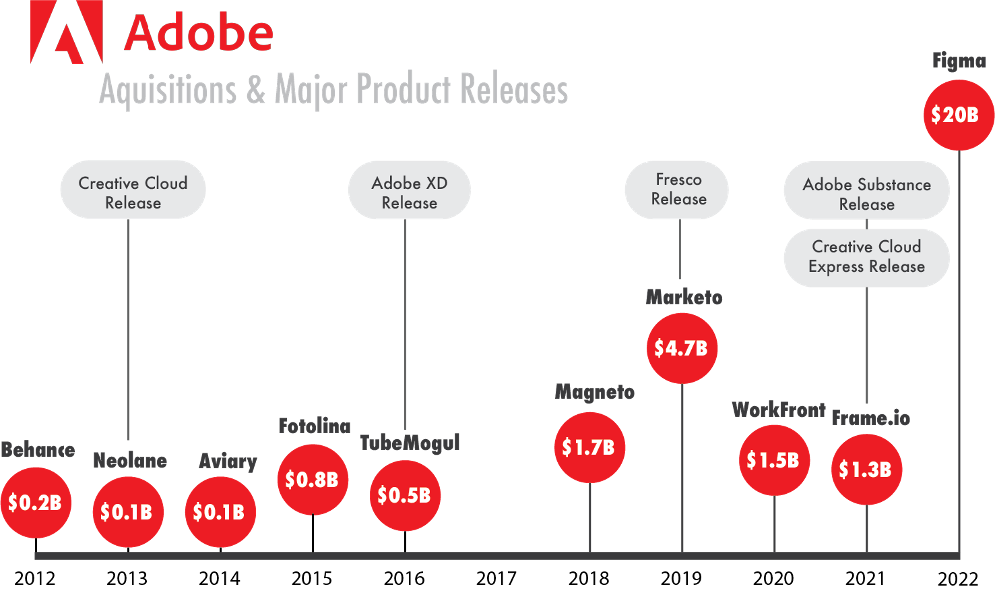

Among the various competitive actions that we analyzed; Adobe’s acquisition activity stood out as one of the more significant actions. Our analysis revealed that Adobe has been highly active in this area, as evidenced by Figure 7.20. As a well-established player in the creative application industry with a proven track record of bringing products to market, Adobe’s expertise extends beyond in-house product development. The company has demonstrated proficiency in acquiring and integrating products into its ecosystem to capture and maximize synergies. In recent years, Adobe has made strategic acquisitions of firms and startups for various reasons such as to obtain intellectual property, acquire talent/customers, and to expand its offerings. One notable acquisition was Figma, a user interface design application, the company purchased for $20 billion dollars making it Adobe’s largest purchase of a direct competitor. In fact the firm already offered a similar alternative to Figma but its market adoption was stagnate and significantly smaller than Figma’s. This purchase was significant not only because of the sticker price but because this was Adobe largest purchase of a direct competitor, signaling that the company is highly attune to its competitors and industry developments. In fact, according to the company’s annual statements, Adobe has made a total of 10 acquisitions since 2018, amounting to over $29 billion dollars in total (Adobe, Inc 2012-2022).

Adobe’s strategic approach to acquisitions reflects the company’s proactive stance in identifying and capitalizing on opportunities to enhance its product offerings, expand its market reach, and maintain its position as a leader in the industry.

Despite its active involvement in the acquisition space, Adobe remains a highly innovative software company that has launched several new products in recent years, such as Substance, Adobe Express, Firefly AI, Fresco, and its game-changing Creative Cloud in 2012. The transition to a subscription-based model with Creative Cloud has had a significant impact on Adobe’s business model and future, enabling exponential growth and delivering more value to customers and shareholders, as evidenced by the company’s impressive stock performance. Adobe’s ability to identify, acquire, and capture market synergies through acquisitions is a unique strength that the company and its management have consistently demonstrated.

Outlook & Recommendation

The outlook for Adobe appears promising, given the expected high growth in the demand for content creation and creative applications. As the digital landscape continues to evolve and businesses increasingly prioritize digital marketing and branding, the need for visually compelling and engaging content is expected to rise significantly. Adobe, with its extensive range of creative tools and solutions, is well-positioned to capitalize on this trend. Furthermore, as technology continues to advance and new mediums of content creation, such as augmented and virtual reality, gain traction, Adobe’s expertise in graphic design and visual experiences can be leveraged to develop innovative solutions for these emerging areas.

Overall, a strong track record of product development, strategic acquisitions, and market leadership in the creative application industry, Adobe is well-positioned to capitalize on the high growth in the demand for content creation and creative applications. To conclude this report, we will provide our strategic recommendations aimed at strengthening Adobe’s business but before we can recommend any changes it is crucial to evaluate the performance of its current strategy in recent years and identify areas where improvements can be made.

Growth in Adobe’s business can happen in fundamentally two ways: subscriber growth in its existing offerings, where the company focuses on incremental improvements to its current products or growth from developing new products. Well, the answer is not whether it should prioritize one over the other rather the question is with its current resources and capabilities how it accomplishes both in a way that retains existing customers and maximizes growth of new ones. The following two graphs tell two very different stories. Figure 8.10 shows that there is a correlation between R&D spending and Revenue. Figure 8.11 tells a different story it shows that the return from higher investments from R&D spending are diminishing or rather that the supernormal growth effects from the transition to a SaaS model are starting to waiver given that revenue growth in 2022 fell to a 10 year low of 12%. This is not an unexpected outcome rather it shows that the company’s products are reaching their maximum effective market share and that the transition to Creative Cloud it nearly complete.

Adobe has effectively leveraged its extensive capabilities and resources to achieve remarkable growth over the past decade. However, there are signs that the business may be returning to a more moderate pace of growth. In conjunction with maintaining and improving the functionality of Creative Cloud, we recommend a three-prong approach to growth.

First, we recommend the company offer a low-cost or free alternative to its $54.99/mo Creative Cloud subscription. This subscription caters towards non-professional and novice creators and would offer tools and features that are less versatile but more user friendly than Creative Cloud. This lower cost subscription would include applications designed specifically for non-professional creators and novice users and would be cross platform compatible. This new subscription would take then name of Creative Cloud Essentials and the Adobe’s current subscription would change its name from Creative Cloud to Creative Cloud Pro. It’s likely there will be some detractions from the Pro version to the cheaper Essentials subscription. To account for this the Pro version price will increase to $59.99/mo and the Essentials subscription will be priced at $19.99/mo and $9.99/mo for students. We believe any loss of Pro subscriptions will be offset by the marginal price increase of the Pro subscription and the overall increase in revenue from Essential subscriptions.

Adobe’s extensive range of creative tools covers the entire content creation landscape. Our second recommendation is for the company to maintain its focus on developing applications that enhance creativity, while also expanding into areas that align with its customers’ needs. Specifically, we propose that Adobe leverage its expertise in creative applications to develop a suite of developer and data analysis tools.

For software developers, these tools would draw on Adobe’s proficiency in graphic design and visual experiences, providing support for UX/UI design and functionality of web and mobile applications. This would complement Adobe’s acquisition of the application prototyping software, Figma, and further enhance synergy.

For analysts, these tools would integrate Adobe’s long-standing experience in building software for data visualizations and graphics, creating an end-to-end system that encompasses data collection, cleansing, processing, and design, all the way to report generation and distribution to decision makers.

This new suite of tools could be bundled into the new Creative Cloud Pro subscription or offered as a stand-alone subscription called Creative Cloud Code, priced at $19.99/month.

Our final recommendation is for Adobe to reevaluate its position in the market with regards to its Experience Cloud platform, which primarily serves as a web analytics and marketing tool for small and medium-sized companies. We believe that a strategic shift away from this area is necessary, as it is unlikely that Adobe will be able to capture a significant share of the market. This is evident from the current market numbers, with Adobe controlling only 1.49% of the web analytics industry, while Facebook and Google together command approximately 71.86% and 12.4% respectively, leaving less than 16% for Adobe and the other 200 web analytics companies (6Sense, 2023).

The second reason for this recommendation is that we do not see significant synergy for companies using Experience Cloud and Creative Cloud, or vice versa. While analytics may benefit marketers and designers (Adobe’s primary customers), the advantages of using Adobe Analytics over Google or Microsoft are negligible. Adobe currently fails to provide comparable value to the competition because they do not offer a comprehensive CRM system, developer community and collaberation tools that businesses now require. Instead, we propose that Adobe seek a strategic partner to merge its Experience Cloud with and, through the partnership, provide the rich content creation tools that it is known for. Figure 8.20 illustrates several potential partners that Adobe could collaborate with such as Microsoft or Amazon to achieve a more holistic platform.

In summary the analysis of Adobe’s industry using the five forces framework, SWOT analysis, and supply chain evaluation has provided insights into the challenges and obstacles faced by the company. Despite Adobe’s impressive capabilities and resources that have led to exceptional growth in the past, signs indicate that the business is returning to more normal levels of growth. As a recommendation, Adobe should continue focusing on building applications that enhance creativity while expanding into areas that complement its customers’ needs. This includes leveraging its expertise in graphic design and data visualization to develop a suite of developer and data analysis tools that can be bundled into its Creative Cloud Pro subscription or offered as a standalone subscription. Additionally, a strategic shift away from Adobe’s Experience Cloud platform, which serves as a web analytics and marketing tool, is proposed, as the market is highly competitive and Adobe’s market share in web analytics is relatively low. Instead, finding a strategic partner to merge the Experience Cloud with and provide rich content creation tools is recommended. The overall outlook for Adobe and the creative application industry is assessed to have moderate potential for profits, considering the low barriers to entry, high competition, and the need for ongoing innovation and investment in research and development to stay ahead.